Discover key trends in Great Britain’s online gambling landscape, including participation rates, demographic influences, payment preferences, and attitudes toward regulation.

Great Britain’s online gambling market is driven by a diverse player base. Our chief goals are to present data and highlight emerging trends in gambling activity, behaviours, opinions and preferences based on an online survey completed by 4167 adults aged 18-75 in Great Britain.

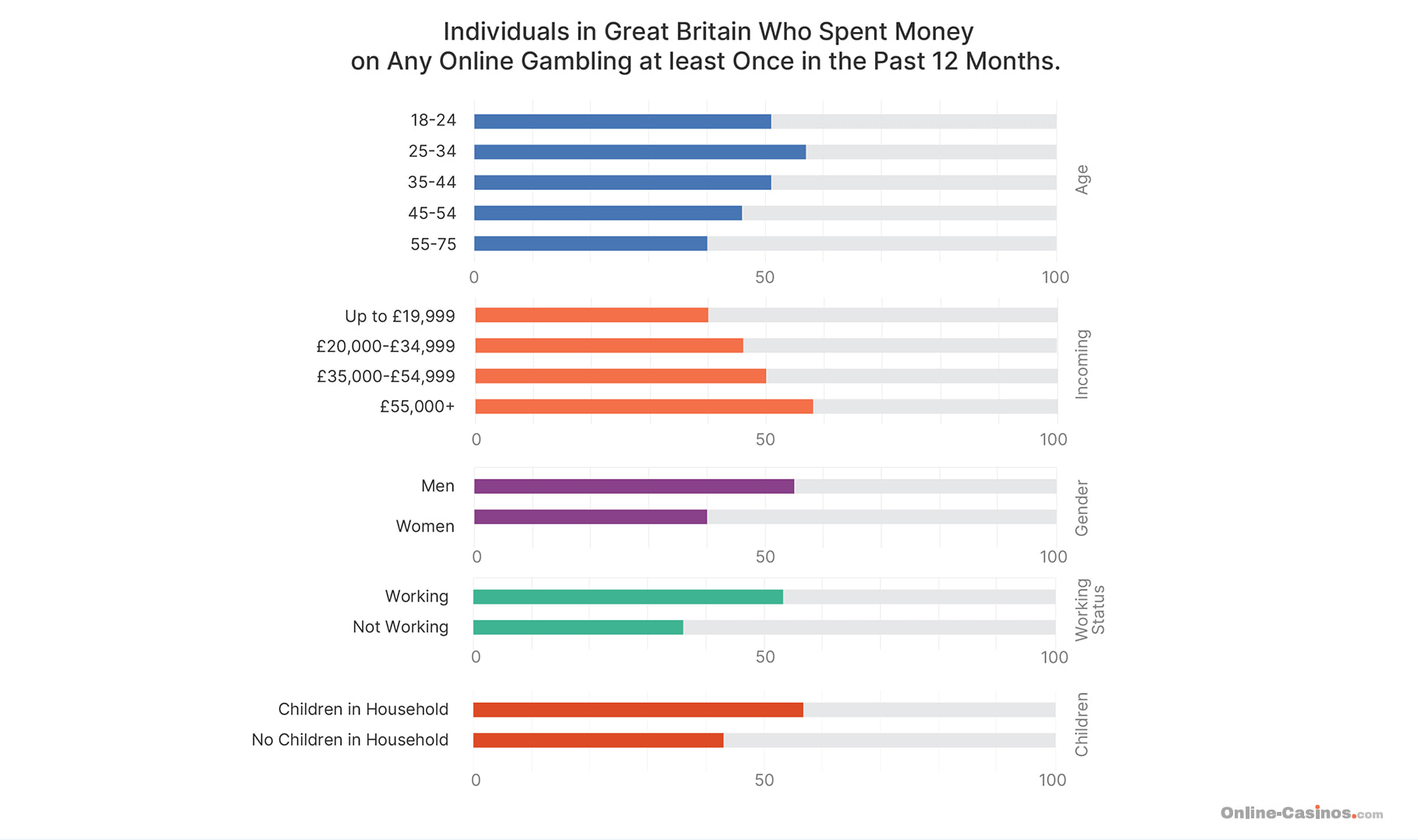

In terms of online gambling activity, the 25-34 age group has the highest percentage of people who spent money on any online gambling at least once in the past 12 months (57%), while the oldest age group (55-75) is significantly lower than all other age groups (40%). Those with the highest annual household income bracket of £55,000 or more are the most likely to participate, with 58% having personally spent money on any online gambling in the past 12 months.

Based on the same metric, the percentage of those who have spent money on any online gambling in the past 12 months is higher among men (55%) vs women (40%), and past 12-month spending is also higher among working individuals (53%) compared to those that are not working (36%). In our respondent group, individuals with children aged 17 and under in the household (57%) also show a higher tendency to engage in at least some sort of gambling activity in the past 12 months than those without children (43%).

Demographic profile of respondents who spent money on online gambling at least once in the last 12 months.

Q12 – Which, if any, of these have you personally spent any money on in the past 12 months online? Base: Total=4167 all adults aged 18-75 in Great Britain n=1,944 all adults aged 18-75 in Great Britain who have spent money on at least one online gambling activity in the past 12 months.

Respondents aged 18-75 in Great Britain who have spent money on at least one online gambling activity in the past 12 months (n=1,944) were presented with seven rules and rights that apply to gambling online in Great Britain as follows:

When it comes to regulation and player rights awareness, we can highlight some demographic profiles that return a higher or lower rate of positive responses. While you might want to check the relevant section for a more detailed breakdown, we can summarise the key findings in the following way:

When we look beyond demographics, we can highlight some of the chief preferences of our respondents in terms of online gambling games, with lottery games leading the way, followed by online sports betting, online casino machine games and other online casino card games.

Q12 – Which, if any, of these have you personally spent any money on in the past 12 months online? Base: Total=4167 all adults aged 18-75 in Great Britain *None indicates answer “None – I have not spent money on any online gambling/betting activities in the past 12 months” Not included in visualisation: Don’t know (3%) Prefer not to say (2%).

Where queried about their preferred payment methods, most online gamblers would pick debit cards (62%), followed by digital wallets and bank transfers at 21%. Unorthodox methods such as cryptocurrencies still show low values with only 6%.

Q14 – What, if any, are your preferred payment method(s) for your online gambling? Base: Total=1944, all adults aged 18-75 in Great Britain who have spent money on at least one online gambling activity in the past 12 months Not included in visualisation: Don’t know (2%) Prefer not to say (1%).

By visiting our website, you are declaring that you are 18+ and agree to our Terms and Conditions, Privacy Policy, and to accept our use of Cookies. This website contains advertisement.